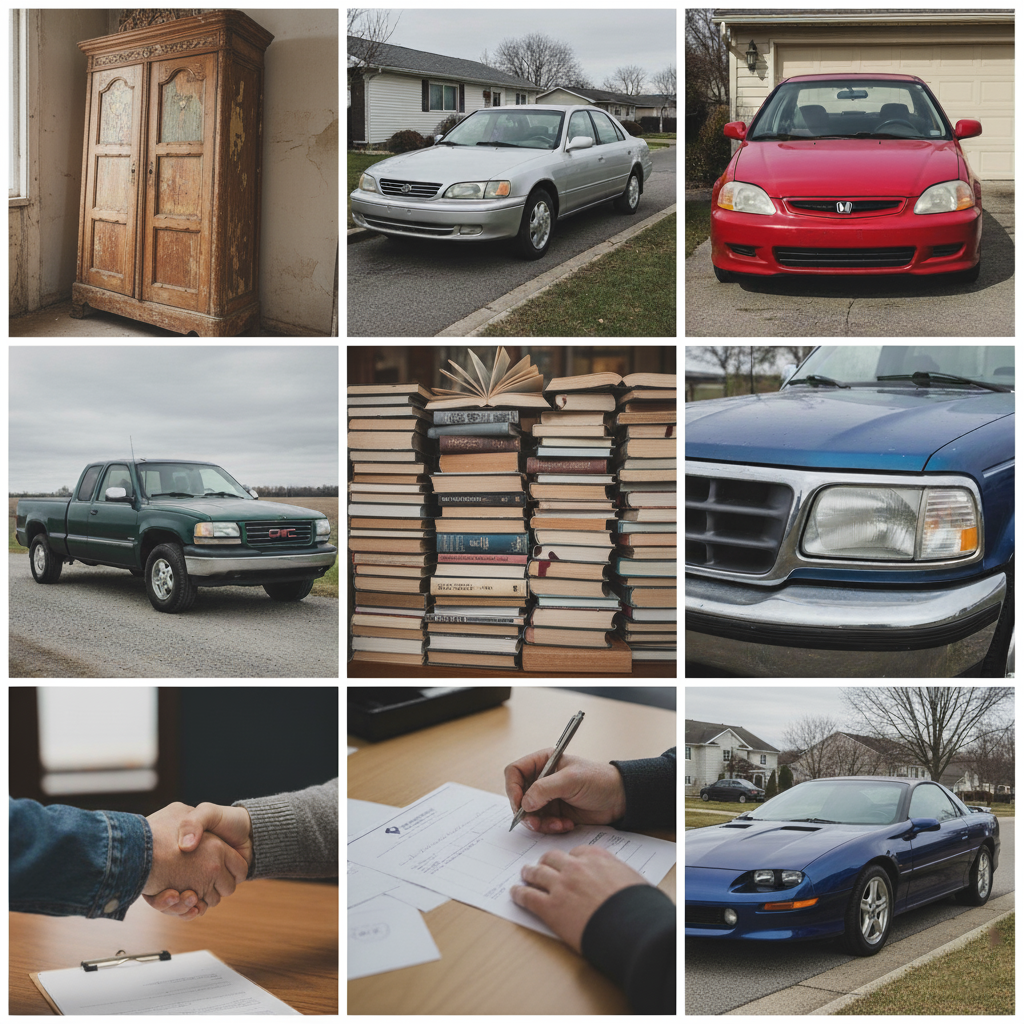

Turn Your Unused Vehicle into a Larger Tax Deduction.

At Carcology Charitable Center, we’re dedicated to getting the highest possible price for your donated vehicle. A better sale price means more support for our community programs and a bigger tax benefit for you.

How Much Will My Tax Deduction Be?

The value of your deduction is directly tied to the selling price of your vehicle.

If your vehicle sells for MORE than $500:

You can deduct the full amount for which it was sold. We'll provide you with an official tax receipt for that exact amount.

If your vehicle sells for LESS than $500:

You can claim the fair market value of your vehicle, up to a maximum of $500.

We Maximize Your Donation's Value!

Decades of Expertise

With almost a decade in the industry, we use our extensive network of buyers and auction houses to find the best sale for your vehicle.

More Funds for Our Cause

We manage our own process from start to finish. This direct approach cuts out the middleman, ensuring a higher percentage of your donation goes directly to our charitable work.

Simple and Swift Paperwork

Once your vehicle is sold, we'll immediately email you the necessary tax receipt. All the documentation you need, delivered straight to your inbox.

Fully Certified Charity

Carcology Charitable Center is a registered 501(c)(3) organization. Your donation is fully tax-deductible to the extent allowed by law.

What Our Donors Are Saying:

“The process was incredibly smooth. The team at Carcology handled everything, and I was so pleased with the tax deduction I received. It’s a wonderful way to support a great cause without any hassle.”

– Jessica M., satisfied donor

Get Rid of Your Old Car and Get a Great Deduction.

Join thousands of others who have supported our cause. Let us take care of your unwanted vehicle at no cost to you.

Disclaimer: Please consult with your tax advisor or accountant to determine the specific tax benefits of your donation. A deduction is only of value if you itemize deductions on your tax return.